Rich Dad Poor Dad Review

Overview

An inspiring book in changing the personal finance view of the readers. The wealth never comes easy and especially tougher in the era of Rat Race where individuals exploit themselves to get the salary as the rewards of their “diligence”. The deeply rooted view held by majorities and me, before I encountered with the book, is subverted by Robert T.Kiyosaki in Rich Dad Poor Dad. Working in Rat Race provides us with stable or growing income and, at the same time, turns the master of money – us – into slaves who is fettered by conventional mindset of personal finance. The book enlightened readers with the way out of Rat Race and secrets of building personal wealth.

Currently I am at my transition from an college student detached from society to an adult who confronts with real world problems. And the primary concern of my first step out of college comfort zone is the topic of money. Unfortunately, I did not ever have any common sense with personal finace and it was actually kind of overwhelming when I received salary from my first internship. Therefore, out of concerns and curiosity, I searched for books and videos for finance management online and that is when I came across with Rich Dad Poor Dad. And I was glad the book comes with a plain yet powerful style in writting, which is accessible even to students in high school, nevertheless presents us with insights into personal wealth.

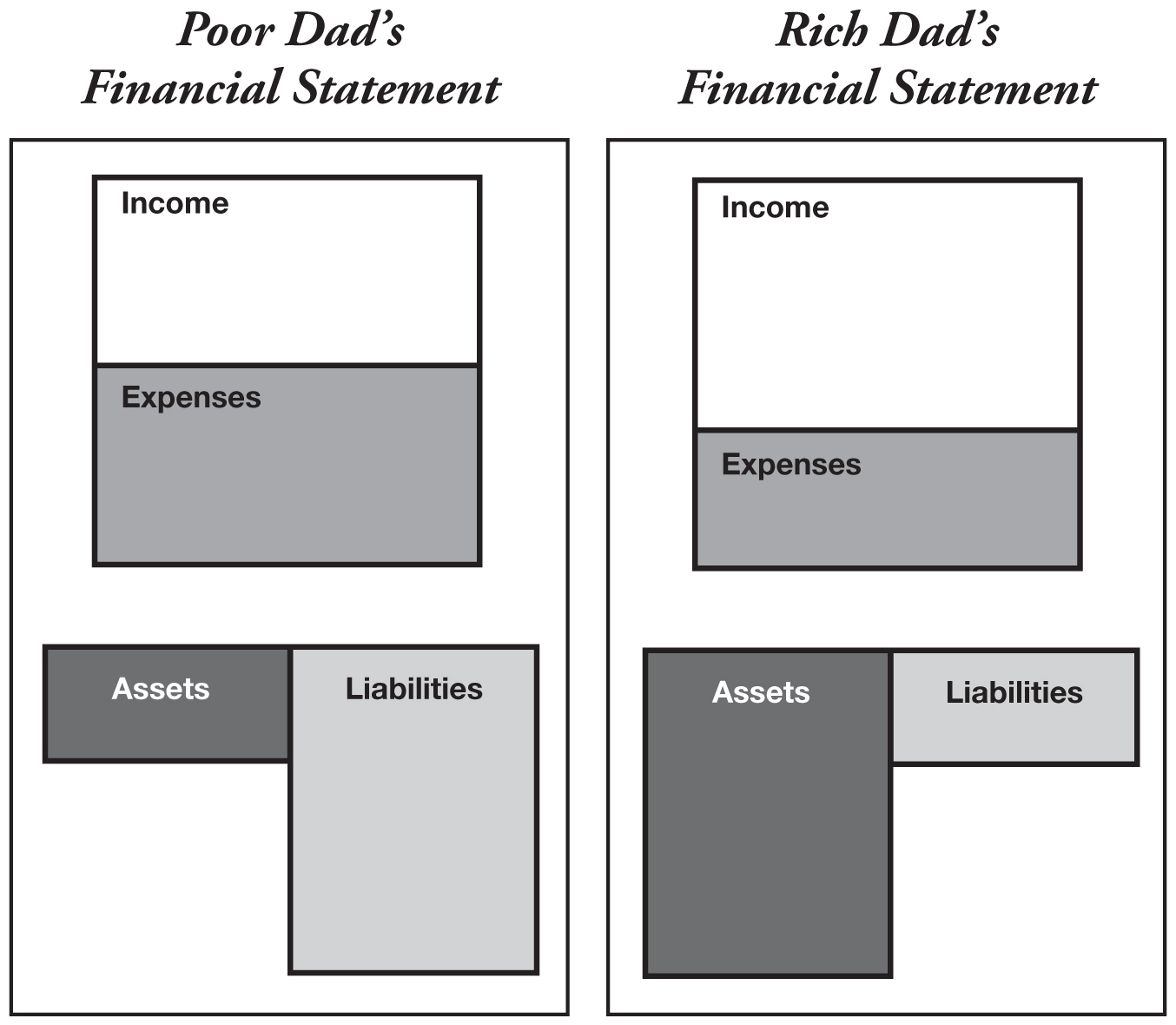

The book starts with education from “Rich” dad and “Poor” dad, which represents two types of views on money and wealth. The poor and middle class stick to salary and liabilities and reluctant to take the risk of investments on assets while the rich generate money with better arranged cash flow between income and assets, which is described as “Each dollar is employeed by you and work for you 24 hour 7 days a week”. The stocks, bonds, real states and the business run by your agents work for the owner without their presence onsite. Though simple as it may sounds, coming up with the way of making the money work for you is never easy and that is exactly where finacial intelligence works. Finacial Literacy and Finacial Intelligence are both the prerequisites for obtaining wealth or being finacially independent. The author suggests accounting, investing, understanding the market and learning the law are four technical pillars of financial intelligence and their synergy will be of great help in the pursuit of wealth. Apart from technical skills, psychology of investing is another important factor in personal finance action. Until we have overcome fear, cynicism, laziness, arrogance and get bad habits kicked off, we could develop our assets columns which will bring us with large cash flow.

Lots of bloggers and youtubers recommand the book as the best introductory reading material of personal finance and my reading experience attest to their applause as an accessible, powerful and thought-provoking book designed for financial novices.

Review by Chapter:

Lesson 1: The Rich Don’t Work For Money

- The poor and the middle class work for money. The rich have money work for them.

- People’s lives are forever controlled by two emotions: fear and greed.

- So many people say, “Oh, I’m not interested in money.” Yet they’ll work at a job for eight hours a day.

Lesson 2: Why Teach Financial Literacy

- It’s not how much the money you make. It’s how much money you keep.

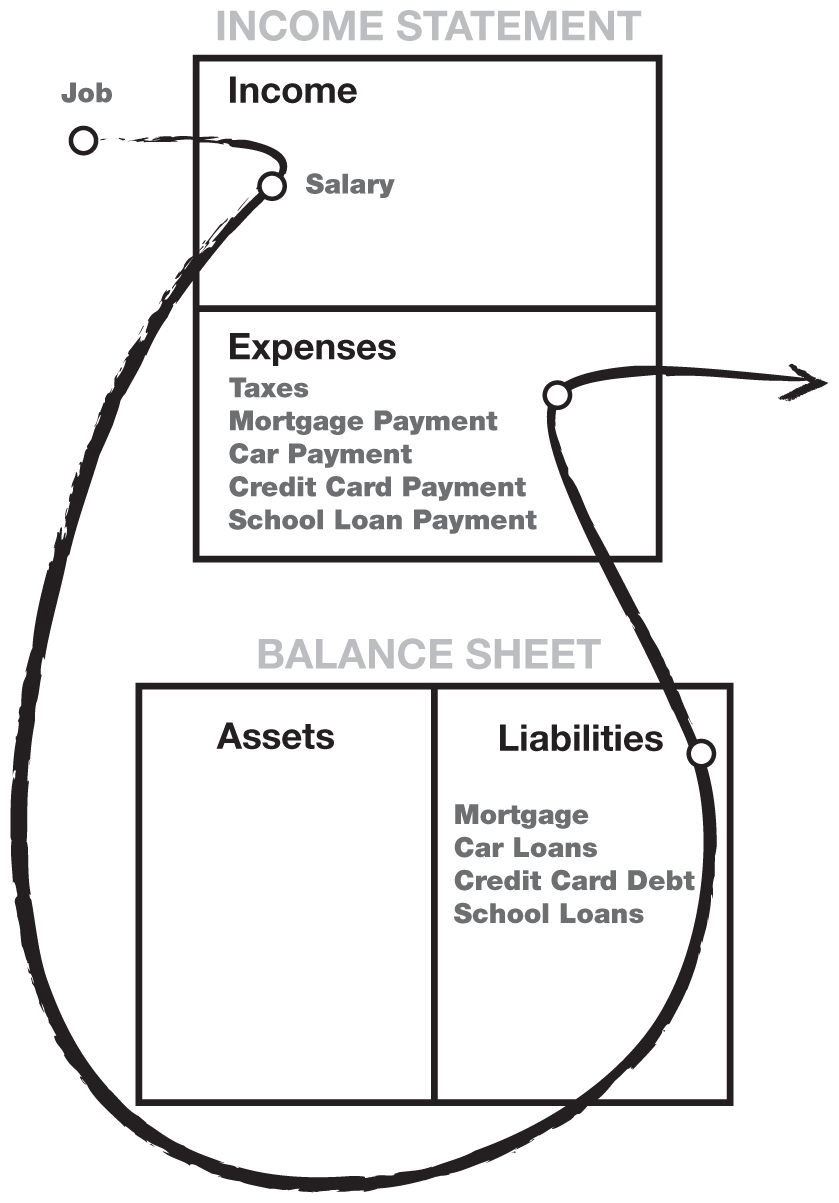

- Rich people acquire assets. The poor and middle class acquire liabilities that they think are assets.

- You must know the difference between an asset and a liability, and buy assets.

- Cash flow tells the story of how a person handles money.

- Observations:

- The rich buy assets.

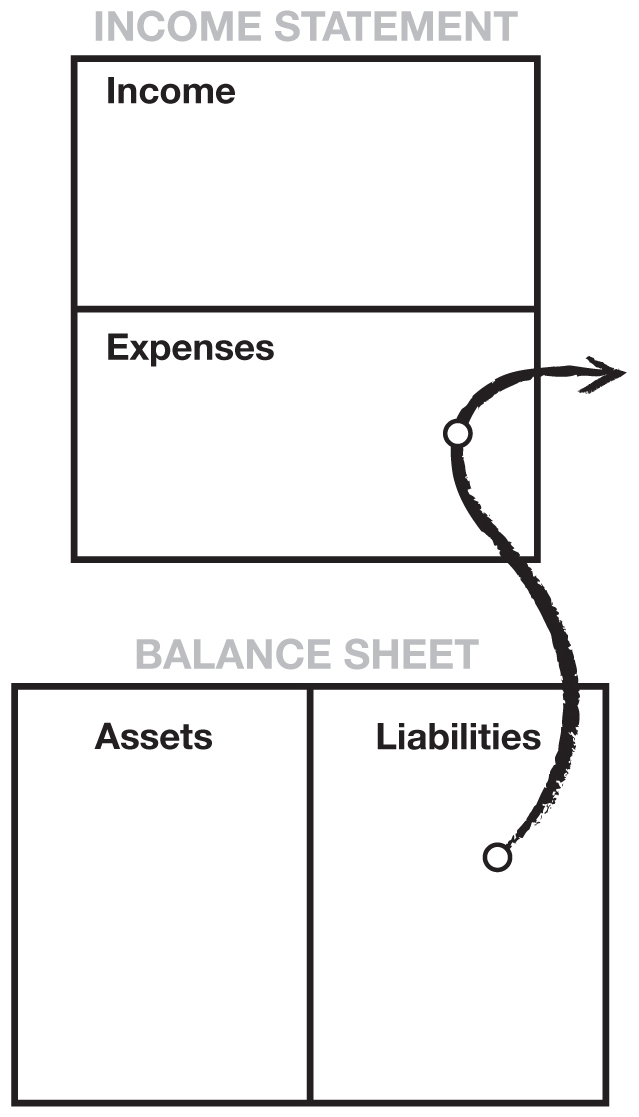

- The poor only have expenses.

- The middle class buy liabilities they think are assets.

Rule #1: You must know the difference between an asset and a liability, and buy assets. cash-flow pattern of an asset:

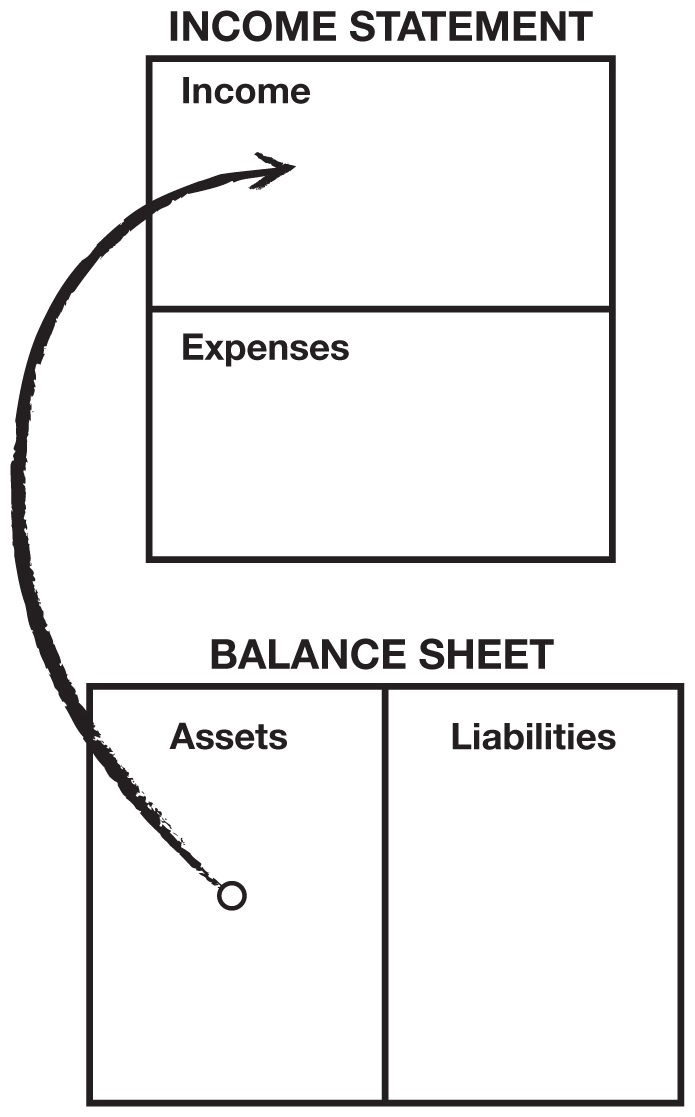

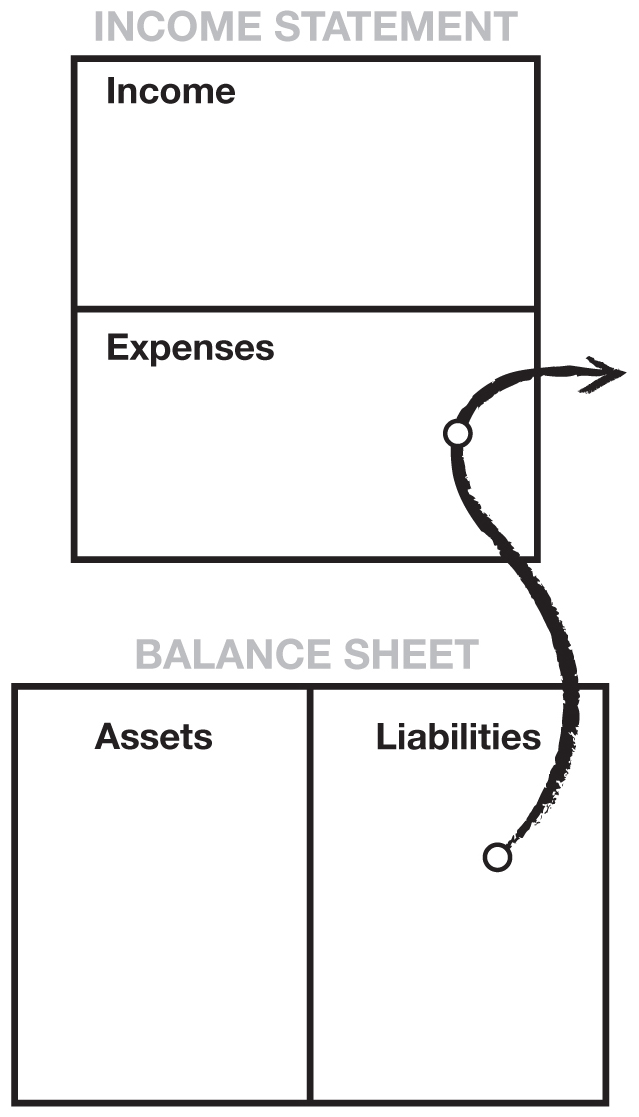

Cash-flow pattern of an asset Cash-flow pattern of liability Cash-flow pattern of the poor Cash-flow pattern of the middle class Financial statements

Lesson 3: Mind Your Own Bussiness

- The rich focus on their asset columns while everyone else focuses on their income statements.

- Financial struggle is often the result of people working all their lives for someone else.

- Keep your daytime job, but start buying real assets, not liabilities or personal effects that have no real value once you get them home.

- Real assets fall into the following categories:

- Businesses that do not require my presence

- Stocks

- Bonds

- Income-generating real state

- Notes(IOUs)

- Businesses that do not require my presence

- Royalties from intellectual property such as music, scripts, and patents

- Anything else that has value,produces income or appreciates, and has a ready market

Lesson 4: The History of Taxes and the Power of Corperations

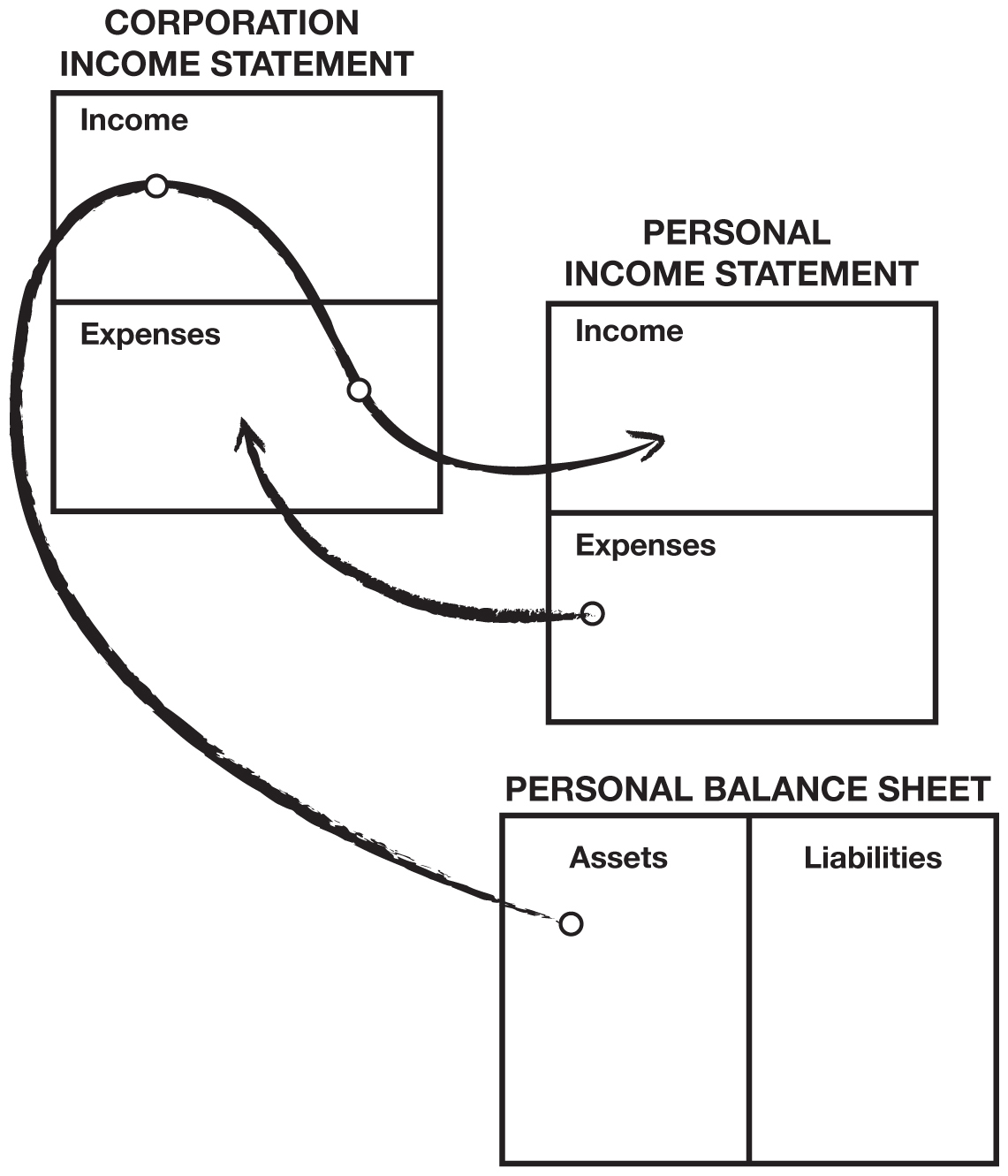

- My rich dad just played the game smart, and he did it through corporations—the biggest secret of the rich.

- My rich dad did not see Robin Hood as a hero.He called Robin Hood a crook.

- If you work for money, you give the power to you employer. If money works for you, you keep the power and control it.

- If you work for money, you give the power to you employer. If money works for you, you keep the power and control it.

- Financial IQ is made up of knowledge from four broad areas of expertise:

- Accounting

- Investing

- Understanding markets

- The law

- Tax advantages

- Protection from lawsuits

Corporate structure

Lesson 5: The Rich Invent Money

- Games reflect behavior. They are instant feedback systems.

- The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth.

- The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth.

- It is not gambling if you know what you’re doing. It is gambling if you’re just throwing money into a deal and praying.

- Great opportunities are not seen with your eyes. They are seen with your mind.

- If you want to be the investor that creates invenstments, you need to develop three main skills:

- If you want to be the second type of investor,you need to develop three main skills.

- Raise money.

- Organize smart people.

The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth.

Lesson 6: Work to Learn - Don’t Work for Money

- Job security meant everything to my educated dad. Learning meant everything to my rich dad.

- “You want to know a little about a lot” was rich dad’s suggestion.

- Job is an acronym for “Just Over Broke.”

- The main management skills needed for success are:

- Management of cash flow

- Management of systems

- Management of people

Lesson 7 Overcoming Obstacles

- Fear:

- The primary difference between a rich person and a poor person is how they manage fear.

- For most people, the reason they don’t win financially is because the pain of losing money is far greater than the joy of being rich.

- Failure inspires winners. Failure defeats losers.

- FOCUS: Follow One Course Until Successful.

- Cynicism:

- Doubt is expensive.

- Laziness

- So what is the cure for laziness? The answer is—a little greed.

- Rich dad believed that the words ‘I can’t afford it’ shut down your brain. ‘How can I afford it?’ opens up possibilities, excitement, and dreams.

- Bad Habits

- Arrogance

Lesson 8 Getitng Started

- There is gold everywhere. Most people are not trained to see it.

- 10 steps as a process to develop your God-given powers, powers over which only you have control.

- Find a reason greater than reality: the power of spirit

- Make daily choices: the power of choice

- Choose friends carefully: the power of association

- Master a formula and then learn a new one: the power of learning quickly

- Pay yourself first: the power of self-discipline

- To successfully pay yourself first, keep the following in mind:

- Don’t get into large debt positions that you have to pay for.

- When you come up short, let the pressure build and don’t dip into your savings or investments.

- To successfully pay yourself first, keep the following in mind:

- Pay your brokers well: the power of good advice

- Be an Indian giver: the power of getting something for nothing

- The sophisticated investor’s first question is:“How fast do I get my money back?” They also want to know what they get for free, also called a “piece of the action.” That is why the ROI, or return on investment, is so important.

- I move a sizable amount of money into the stock of a company that he feels is just about to make a move that will add value to the stock, like announcing a new product. I will move my money in for a week to a month while the stock moves up.Then I pull my initial dollar amount out, and stop worrying about the fluctuations of the market, because my initial money is back and ready to work on another asset. So my money goes in, and then it comes out, and I own an asset that was technically free.

- Use assets to buy luxuries: the power of focus

- Choose heroes: the power of myth

- But heroes do more than simply inspire us.Heroes make things look easy. Making it look easy convinces us to want to be just like them. If they can do it, so can I.

- Teach and you shall receive: the power of giving

Still Want More? Here Are Some To Do’s

- Stop doing what you’re doing. Stop doing what is not working, and look for something new.

- Look for new ideas.

- Find someone who has done what you want to do. Take them to lunch and ask them for tips and tricks of the trade.

- Take classes, read, and attend seminars.

- Make lots of offers.

More suggestions:

- Finding a good deal, the right business, the right people, the right investors, or whatever is just like dating.

- Jog, walk, or drive a certain area once a month for 10 minutes.

- Shop for bargains in all markets.

- Look in the right places.

- Look for people who want to buy first.Then look for someone who wants to sell.

- Think big.

- Learn from history.

- Action always beats inaction.

Three forms of income:

- Ordinary earned

- Portfolio

- Passive

All of you were given two great gifts: your mind and your time. It is up to you to do what you please with both. I wish you great wealth and much happiness with this fabulous gift called life. – Robert Kiyosaki

More Reading

- More books recommanded (credit to Youtuber 艾财说imoneytalk )

- CashFlow game